Ethereum Volume Bot - Boost ERC-20 Token Trading Volume (2026)

One of the biggest challenges after launching an ERC-20 token on Ethereum is maintaining consistent trading activity. Once initial promotion ends, trading volume often drops sharply, and investor interest fades along with it.

A volume bot is an effective tool to solve this problem. Through automated buy/sell transactions, you can maintain trading volume on DEXs like Uniswap, PancakeSwap, and SushiSwap, and secure top visibility on DexScreener and DEXTools. As trading volume and maker count increase, your chances of entering trending pages rise, leading to organic investor interest.

This guide explains step-by-step how to use a volume bot on Ethereum.

Ethereum Volume Bot: Step-by-Step Guide

The Ethereum Volume Bot is a tool available to everyone. You need to connect an Ethereum compatible wallet with enough ETH for gas fees and volume generation. Once these requirements are met, follow these steps:

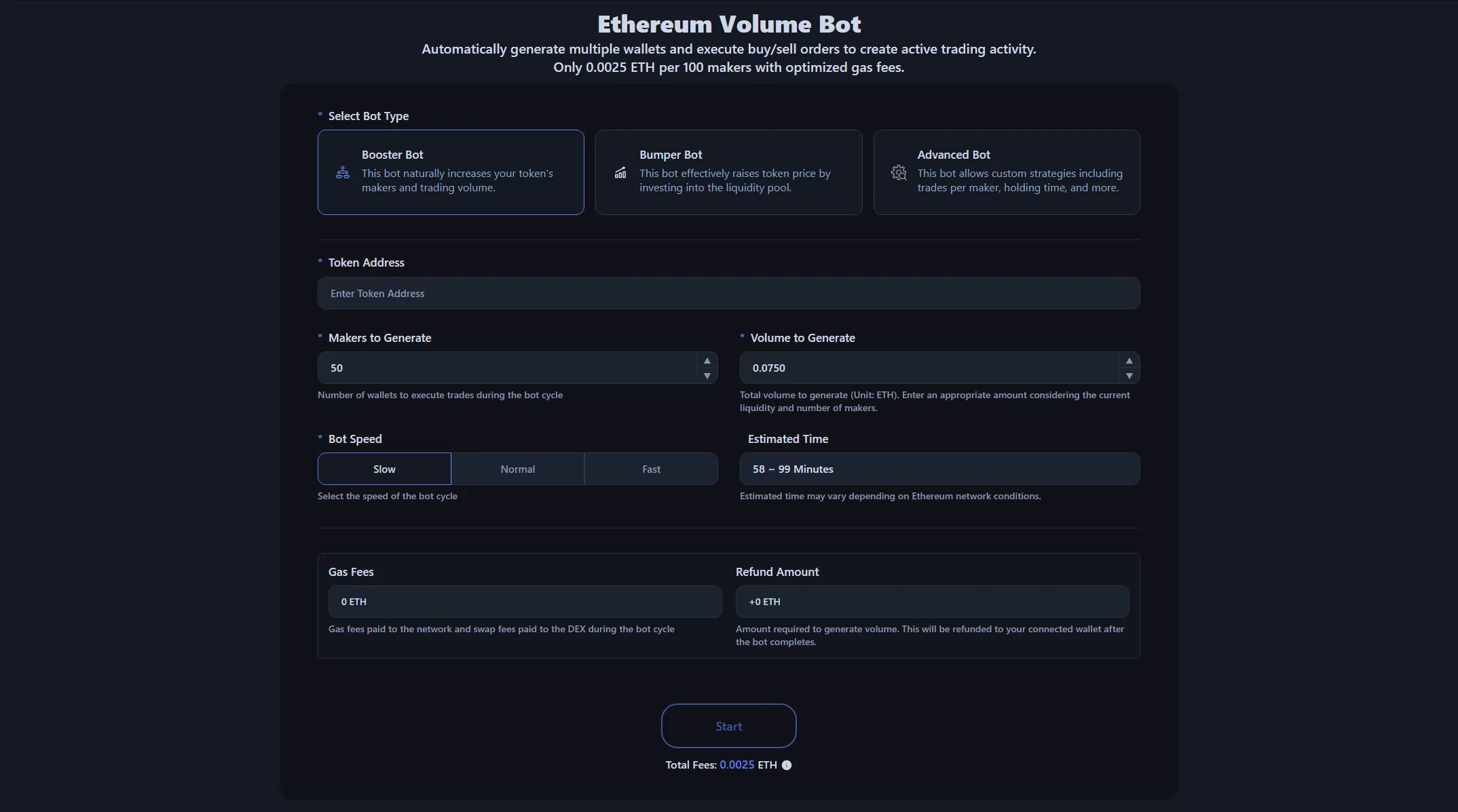

- Select Bot Type: Choose the bot type that fits your purpose.

- Booster Bot: Generates natural trading volume through optimized gas and swap fees.

- Bumper Bot: Increases token price by directly injecting ETH into the liquidity pool.

- Advanced Bot: For experienced users who want to configure detailed parameters like buy/sell count per maker and holding time.

- Enter Token Address: Input the address of the token or meme coin you want to boost.

- Configure Settings: Set the number of makers to generate, trading volume or ETH amount to inject into the liquidity pool, and bot speed.

- Check Bot Preview: Review the gas fees for the bot cycle, DEX fees, and the ETH amount to be refunded after completion.

- Click Start Button: Once payment is confirmed in your wallet app, the bot will start working.

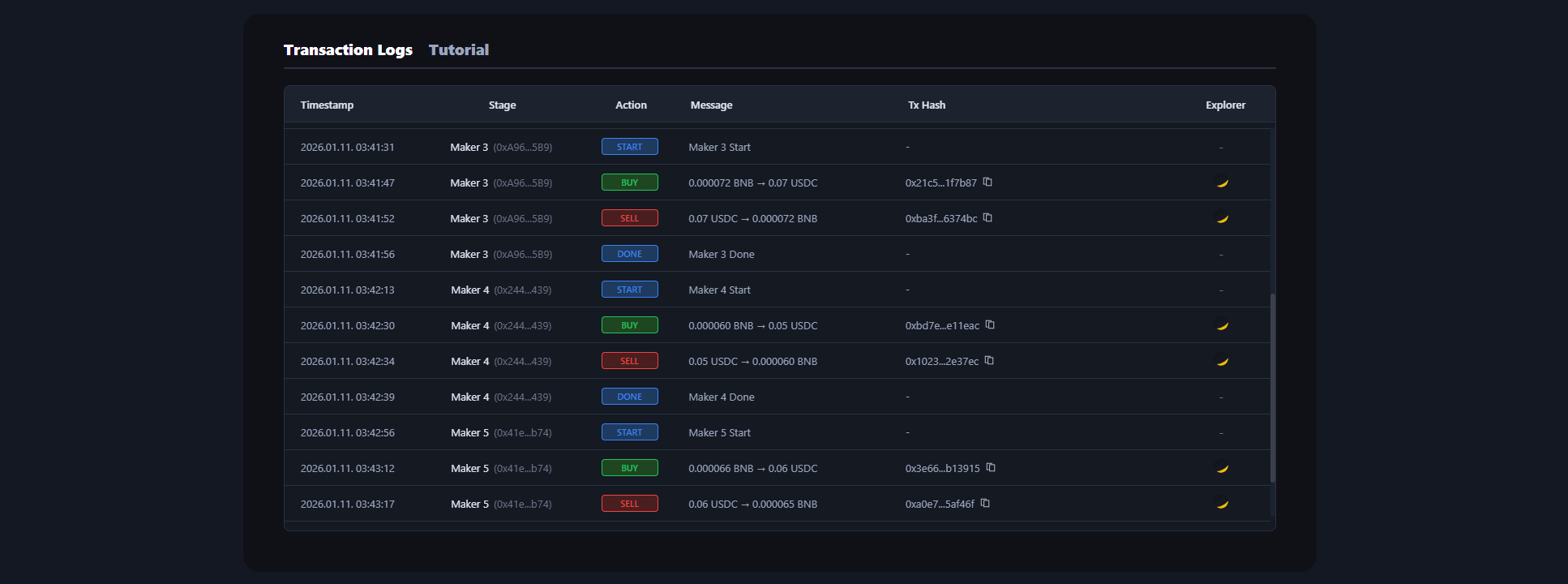

- Check Bot Logs: View all transaction logs performed by the bot in the Transaction Logs tab at the bottom.

For detailed tutorials on Ethereum Volume Bot, visit the Ethereum Volume Bot Guide Page.

Once the bot starts, the token boosting effect appears instantly on all DEXs and screeners. When the bot cycle ends, all remaining ETH is automatically refunded to the wallet that made the payment.

What is an Ethereum Token Volume Bot?

It's an automation tool to increase trading volume and maker count on the Ethereum network. It creates multiple wallets and automatically executes buy/sell orders to make your token appear actively traded on DEXs. This helps secure top visibility on platforms like DexScreener and DEXTools, driving organic investor interest.

Alphecca's volume bot accurately calculates required gas fees and features an intuitive interface that anyone can use without programming knowledge.

Benefits of Alphecca's Ethereum Volume Bot

Here's what sets Alphecca apart from Telegram bots and other volume bot providers:

- Accurate Cost Calculation: Calculates gas usage and real-time gas costs for all transactions with high accuracy. Automatically reflects swap fee rates for each DEX including Uniswap, PancakeSwap, and SushiSwap, so you can see actual costs before starting.

- Gas Fee Optimization: Ethereum gas fees fluctuate significantly based on network congestion, making accurate cost prediction crucial. Alphecca optimizes individually to reduce unnecessary gas spending.

- Transparent Transaction Logs: All transactions performed by the bot are disclosed in real-time. You can verify each maker's buy/sell timing and gas fees, and validate everything on Etherscan.

Ethereum Volume Bot log screen where you can check all transaction records

Ethereum Volume Bot log screen where you can check all transaction records

Ethereum Volume Bot Cost

Available at 0.0025 ETH per 100 makers, with no additional cost based on trading volume. Gas fees and DEX swap fees are calculated and displayed before starting the bot, executed at optimized amounts. You can also see the ETH to be refunded after the bot completes.

Alphecca Volume Bot Security for Ethereum

Alphecca transparently discloses all transactions. You can verify each maker's buy/sell timing, gas fees used, and amounts to be recovered, all verifiable on Etherscan. We do not hold user assets or store wallet information. For inquiries, our support team is available 24/7.

Frequently Asked Questions

Here are frequently asked questions about using the Ethereum Volume Bot. If you have questions about how it works, costs, or security, check below.

How does the Ethereum Volume Bot work?

The Ethereum Volume Bot automatically calculates DEX swap fees, network gas usage and fees, and volume generation costs when you input parameters. Once payment is complete, the amount minus service fees moves to a newly created main wallet. The main wallet creates the set number of maker wallets and distributes funds to each. Each maker wallet completes token buy and sell operations, then returns funds to the main wallet. This cycle repeats until all makers complete their tasks, and the final remaining amount is automatically refunded to the connected wallet.

Interested in meme coins? Check out the Ethereum Meme Coin Creation Guide.

How does the Ethereum Volume Bot lead to profit?

Trending rankings on screeners like DexScreener are determined by a combination of trading volume, unique maker wallet count, and trading consistency. Tokens with active trading from various wallet addresses are more likely to appear in trending sections and attract organic investor interest. Understanding this algorithm is key to maximizing token visibility.

Does the bot keep running if I leave the page?

Yes. Once bot execution starts, it continues running even if you leave the page or close the browser entirely. When the bot completes, remaining ETH and tokens are automatically returned to the wallet that made the payment.

Is using the Ethereum Volume Bot legal?

Legality depends on your local regulations and platform terms. Users must comply with applicable laws in their jurisdiction. Alphecca provides tools for legitimate trading activity enhancement, but users are responsible for how they use the tools.

Wrapping Up the Ethereum Volume Bot Guide

After token launch, project success depends on visibility. No matter how great the idea or technology, growth is difficult if investors don't notice it. A volume bot is an effective tool for securing this initial visibility. Ethereum boasts the largest DeFi ecosystem and highest liquidity, making it the mainnet that investors worldwide pay attention to. With the Ethereum Volume Bot, professional trading volume management is possible without complex setup.